Last updated on January 23rd, 2024 at 09:04 am

The world’s crazy about cryptocurrencies, and lots of new trading places popped up quickly. People wonder, “How to learn Coindcx ? How to trade cryptocurrency?” If you’re new to the crypto world, just read this whole article to Learn Coindcx. We’ll tell you about the best crypto exchanges in India and how to start trading on CoinDCX.

You can do margin trading with cryptocurrency, which means you borrow money to trade more. This helps you trade bigger and better. So, if you’re a new investor, stay tuned. We’ve got your back with the best crypto exchanges in India and a guide on how to trade and Learn CoinDCX for smarter investments.

Table of Contents

What Is CoinDCX?

CoinDCX is a new crypto trading platform. It has over 200 cryptocurrencies, like Ethereum and Bitcoin. This is good because many traders can use it. But there’s a problem. Some coins might be scams because they aren’t checked well. It was started in 2018 by Neeraj Khandelwal and Sumit Gupta.

It’s the first Indian crypto unicorn. They have 125 million users. CoinDCX trades over 200 cryptos, including Bitcoin, Ethereum, Anchor Protocol, Shiba INU, and Polygon. CoinDCX is valued at around $2.15 billion. They got $90 million in August 2021 and $135 million recently. Big names like Facebook’s co-founder Eduardo Saverin’s B Capital, Coinbase Ventures, and Polychain Capital support CoinDCX.

How to Open an Account in CoinDCX?

To trade crypto on CoinDCX, first, sign up via the app or website. Complete the KYC verification. Follow these steps. It’s simple. Review the steps below to learn coindcx.

Visiting the Website

To sign up, go to the official website. Press the ‘register’ button. Placed at the top right corner to begin.

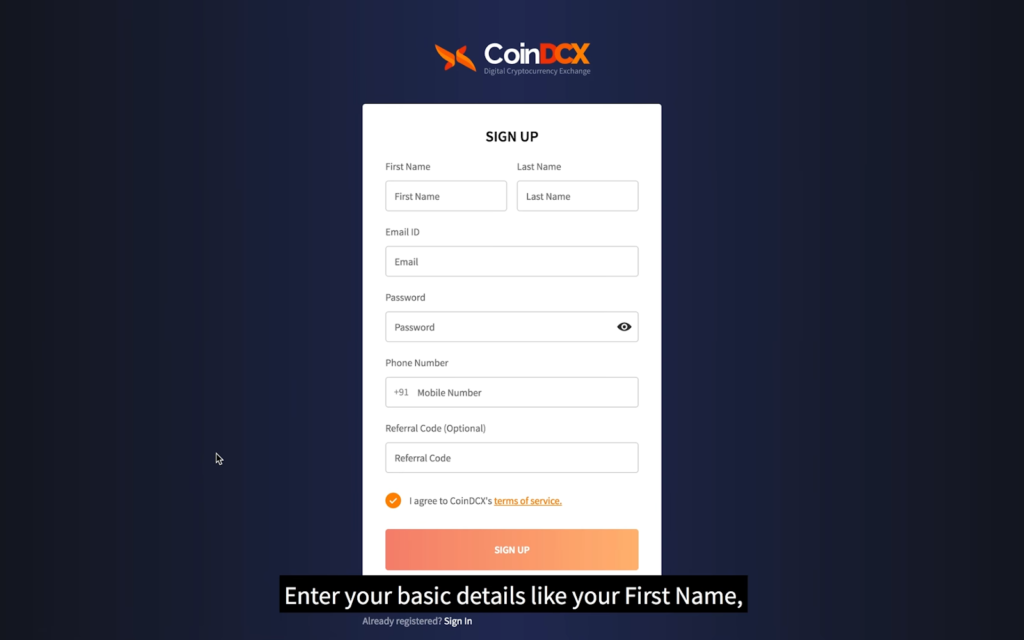

Filling in the Details

To sign up, enter your name, phone, email, and other info. Click ‘Sign-Up’ when done.

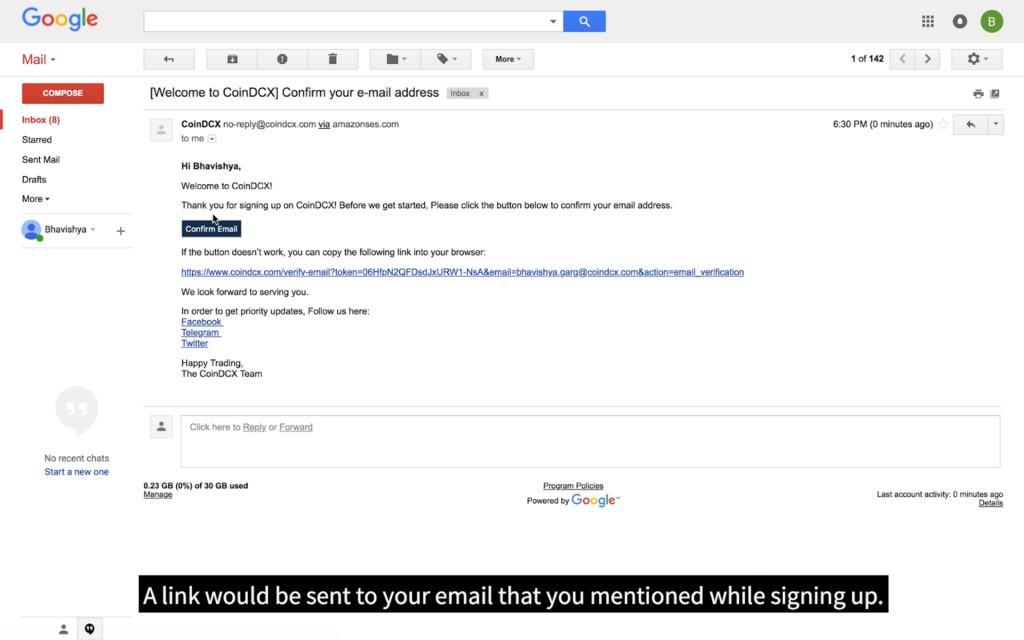

Verify Phone Number and Email

To check your phone number, you’ll get a code on your phone. Enter it on the site. For email verification, click the link sent to your mailbox by the website.

Verify Bank Account

Verify your bank account by clicking ‘Verify Bank Account’ in your profile. Fill in banking details, confirm deposits, and provide the received 12-digit UTR number.

If You want To Open account Through app

Let’s set up your account:

Open CoinDCX app and tap “Create Account.”

Choose “Create account with Google.”

Pick your Google account.

Enter your mobile number.

Verify with OTP.

Create a 6-digit PIN for secure login.

Re-enter PIN for confirmation.

What are Crypto Futures?

Crypto Futures contracts are a lot like crypto derivatives, but there’s one big difference – they don’t have an expiration date, unlike traditional futures contracts. So, Crypto Futures are a kind of derivative product. They closely follow the price of the underlying asset and give you all the benefits of holding a futures contract.

Here’s an example to learn CoinDcx crypto future . Imagine Person A has $100 to trade. They’re feeling positive about Bitcoin (BTC) and decide to go long on the BTC/USDT Futures contract with 10x leverage. Now, they have a contract worth $1000, a $100 margin, and a $900 loan. Leverage is what lets you increase your potential gains when betting on the asset’s price going up.

Crypto Futures are different from other crypto market tools like spot, margin trading, and options trading. Spot trading is where everyone starts, and margin trading lets you borrow some money to buy more crypto for trading. Futures and options, on the other hand, offer more leverage and flexibility to traders.

Let’s learn coindcx crypto margin. In crypto, margin trading is when people buy more than they can afford. CoinDCX offers 10X leverage in 250+ markets.

Crypto Investing vs Trading

In the crypto world, we have two main ways: investing and trading. Both use digital assets, but they’re different. Let’s see to more with coindcx learn.

Crypto Investing involves holding onto cryptocurrencies for the long term, with a focus on potential growth. People look this technology often buy the cryptocurrency and keep it for several years. While, hoping its value will increase and bring them profits. This approach suits those who want to invest in crypto without being too active. It means you don’t trade very often, and you’re less exposed to quick market changes. Some popular strategies in crypto investing are dollar-cost averaging and building a diverse crypto portfolio.

On the other hand, Crypto Trading is about short-term gains by actively buying and selling cryptocurrencies. Traders rely on technical analysis, studying charts, trends, and market indicators. They make quick decisions based on signals and use strategies like day trading, swing trading, scalping, and arbitrage. This is for people who are okay with higher risks and want faster results. It involves more trading, higher risks, and a chance for quicker returns.

How to do margin trading on CoinDCX ?

Before we answer that question, let’s understand what margin trading is and why it’s good. Margin trading means you trade using only a part of your own money and borrowing the rest from the exchange or broker. This lets you increase your investment size. For example, if you have $100 and use 10x leverage, you can trade as if you have $1000. Additionally, margin trading allows you to bet on whether an asset’s price will go up (Long) or down (Short).

Today, the Bitcoin Futures market alone has an open interest of over $12 billion. In March 2023, Bitcoin Futures had over $1.3 trillion in trading volumes worldwide, across major exchanges. But this is still less than the trading volumes during the 2021 bull run, when it hit $2.69 trillion.

Initiating a Long Position

In a long position, you buy assets and aim to sell them when the price increases.

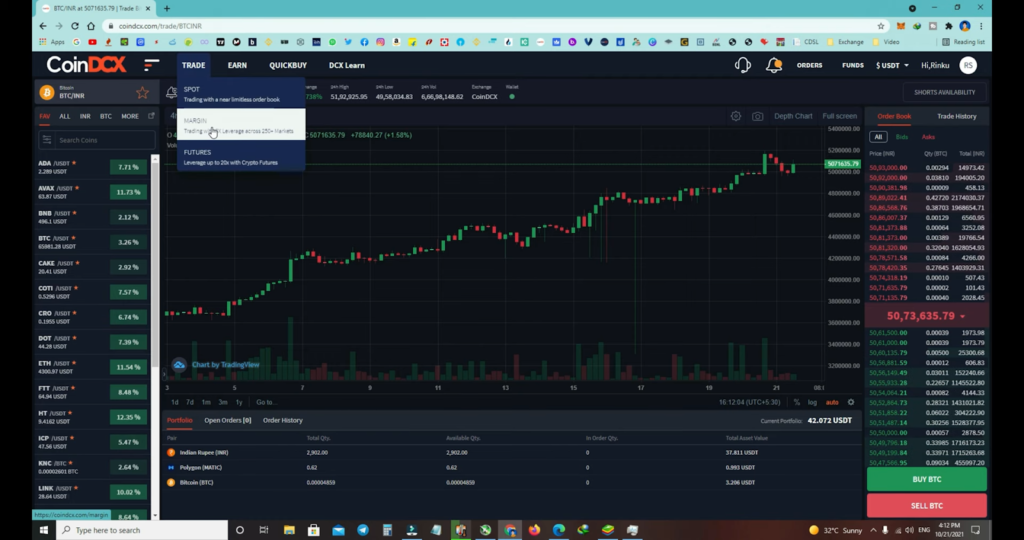

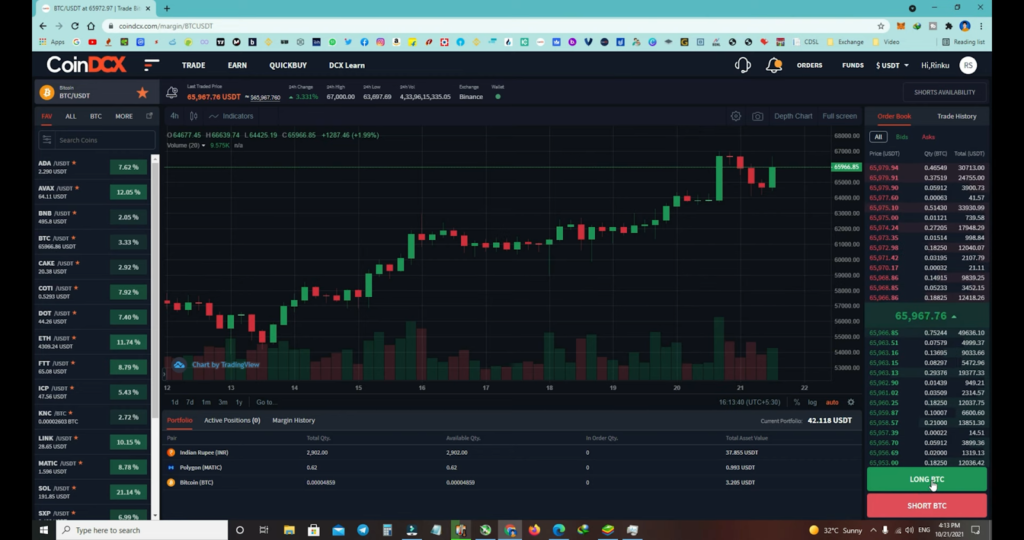

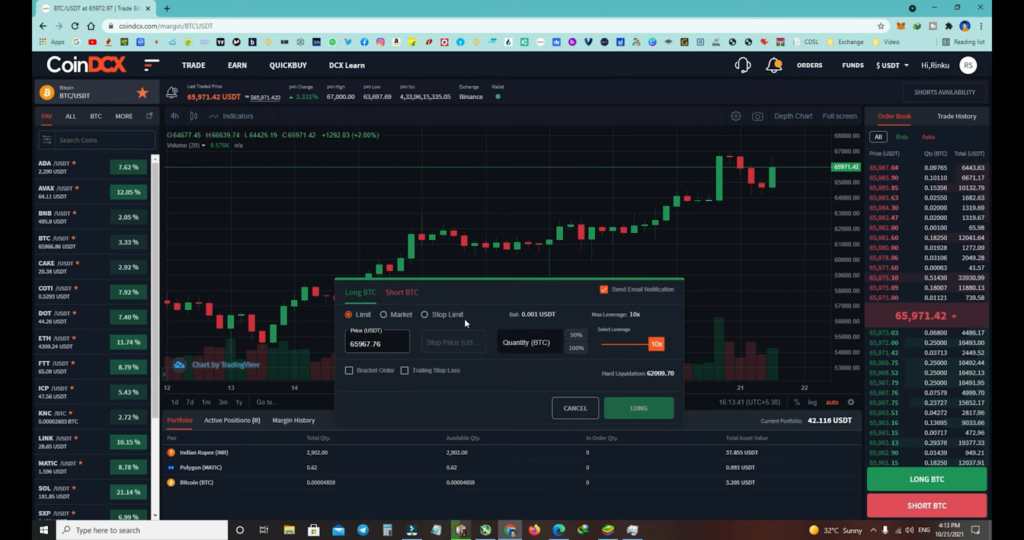

- Go to the Trading page, select Margin, and choose your pair.

- Set up a Margin Buy order by specifying quantity, leverage, and price.

- Optionally, set a Target Price and Stop Loss Price for a Bracket Order (BO).

- Click ‘Long’ to place your order.

To close your position, choose ‘Exit’ or wait for the Stop Loss to trigger.

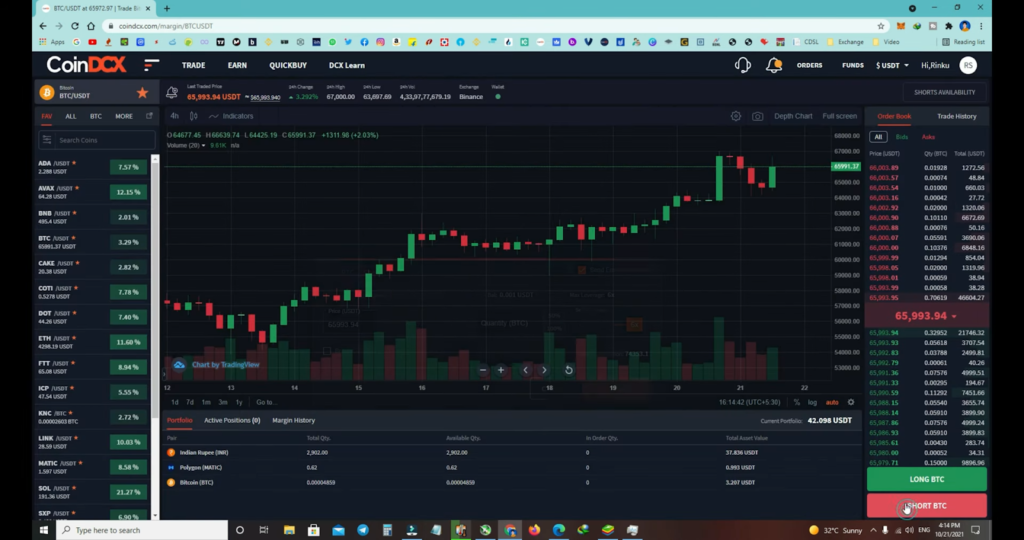

Initiating a Short Position

In a short position, you sell assets you don’t own and buy them back later at a lower price.

- Go to the Trading page, select Margin, and choose your pair.

- Set up a Margin Buy order by specifying quantity, leverage, and price.

- Optionally, set a Target Price and Stop Loss Price for a Bracket Order (BO).

- Click ‘Short’ to place your order.

Remember, high leverage increases risk, so analyze before trading.

Examples:

- Long with 4x Leverage

For a 1000 XRP long at 4x leverage, the exchange collects 0.0225 BTC as collateral. - Short with 3x Leverage

For a 1000 XRP short at 3x leverage, the exchange lends 1000 XRP against 0.03 BTC collateral.

How to Close a Margin Position:

Adding a Target Order

- Click ‘Add Targets’ for an open position.

- Specify the quantity and price for the target order.

- Submit the request.

How to Change Leverage:

Adding Margin

- Click ‘Add Margin’ for an open order.

- Enter the additional margin amount.

- Check the new hard liquidation price and leverage.

- Submit the request.

Removing Margin

- Click ‘Remove Margin’ for an open order.

- Enter the amount to remove from the initial margin.

- Check the new hard liquidation price and leverage.

- Submit the request.

How To Fund CoinDcx Account ?

Deposit funds in CoinCDX via bank transfer. Buy Bitcoin on CoinCDX.

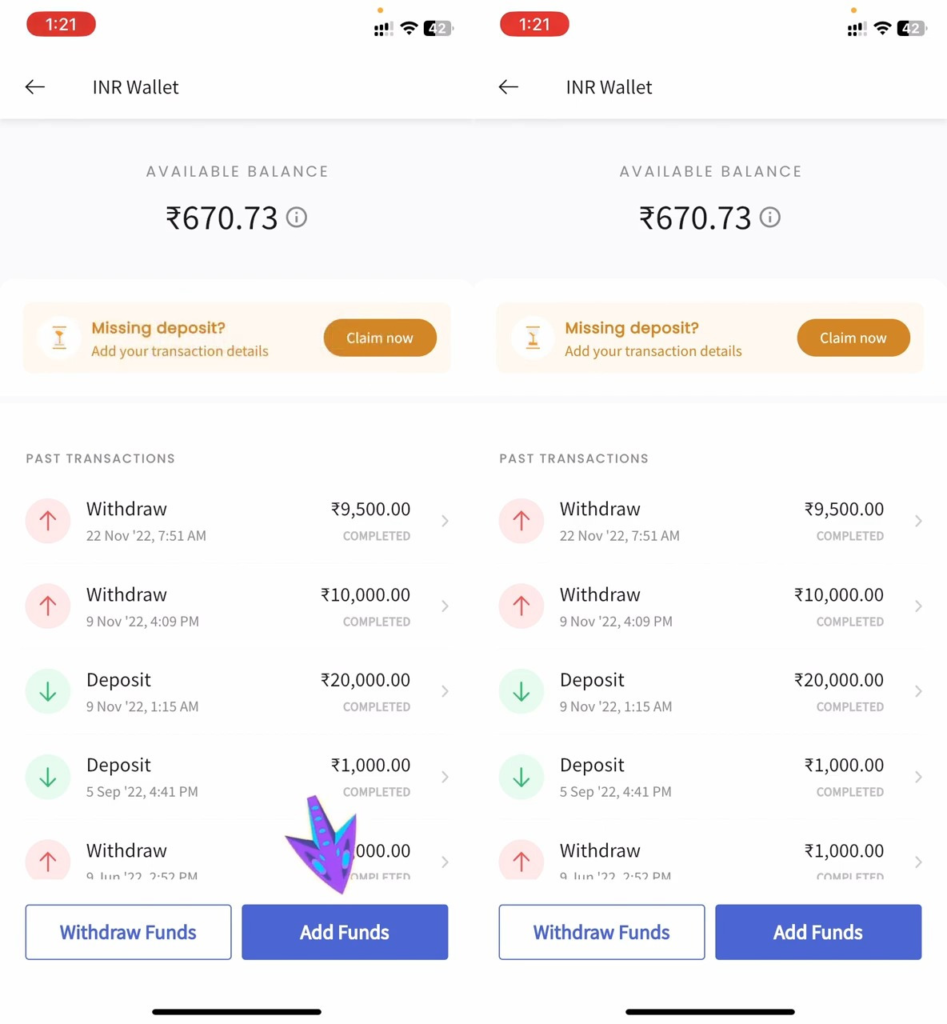

To add funds to your CoinCDX wallet, follow these simple steps as you learn coindcx:

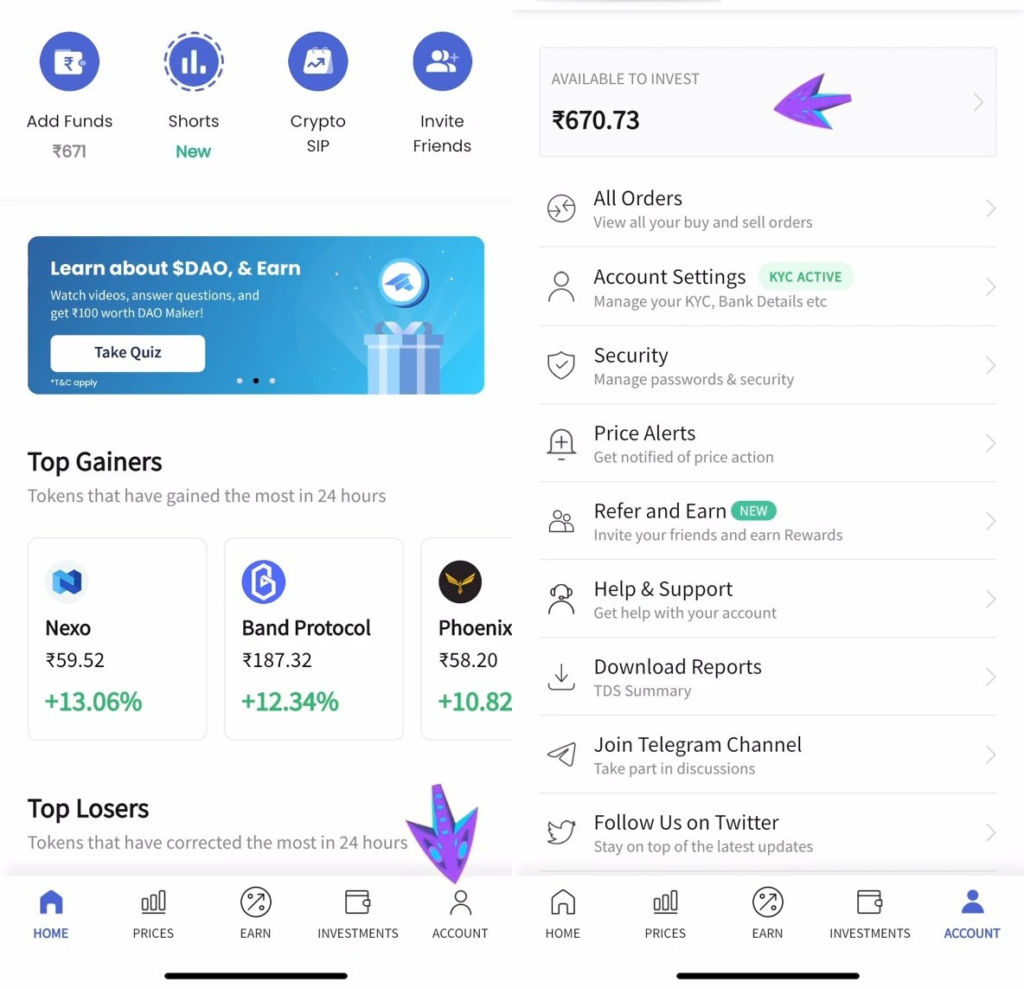

1. Click “Add Funds” on the CoinCDX Homepage.

2. Select “Bank Transfer” and click “Continue.”

3. Log in to your NetBanking Account and copy the displayed details.

4. In your net banking account, choose “Add Payee.”

5. Enter the payee bank account details from step 2 on the CoinDCX App Transfer Page.

6. Click “Confirm the transaction” and jot down the Reference No.

7. Enter your Reference No. in the Transaction ID field to complete the transfer.

After depositing your fiat currency in your CoinCDX wallet, you can start buying cryptocurrency:

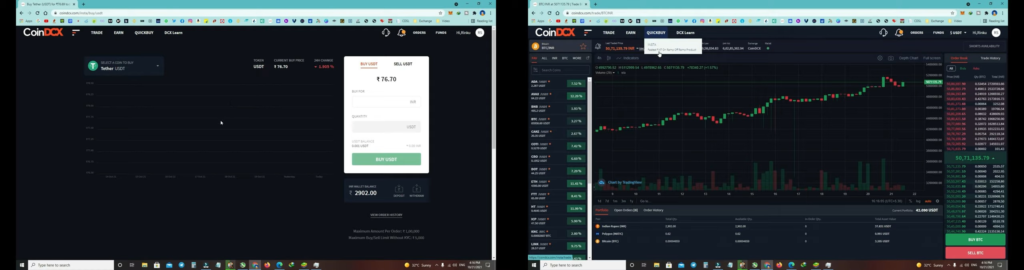

1. Go to the “Prices” section and click “Bitcoin.”

2. Click “View Price Chart” to check Bitcoin’s recent performance.

3. Tap “Buy” and enter the amount in INR for Bitcoin.

4. Click “Buy BTC” to confirm your order.

5. Once confirmed, you’ll see your coins in “Investments” and orders in “My Orders.”

Conclusion

We hope this article helped you learn CoinDCX. Thinking about crypto? Research and read reviews. New investors, need to learn how to invest wisely. CoinDCX offers a Crypto Investment Plan (CIP). CIP automates fixed investments, lowering risk and stress.