Last updated on April 22nd, 2024 at 12:46 pm

Introduction

Even if you have recently stepped into the Cryptocurrency world, I am sure the terms Centralized exchanges and Decentralized exchanges are not new to you. We will understand the comparison of Centralized Exchange vs Decentralized Exchange (CEX Vs DEX) in this article.

Cryptocurrency exchanges are marketplaces where investors can buy, sell and swap their cryptocurrencies. In layman terms, these are platforms that help you exchange your currency with other investors.

Based upon the control over the exchange, Cryptocurrency Exchanges are of two types. Centralized Cryptocurrency Exchanges and Decentralized Cryptocurrency Exchanges. As their names suggest, Centralized Exchanges are controlled by an organisation however, Decentralized are not. In the case of Decentralized Exchanges, the smart contracts on the blockchain manage all the transactions.

Apart from the control over the exchanges, there are a lot of other differences between the two types of exchanges. We will categorize them as:

- Ownership of Assets

- Security

- Privacy

- User Friendliness

- Fees

- Speed

- Liquidity and;

- Other Issues

Further, I have prepared a comparison table between Centralized Exchanges Vs Decentralized Exchanges at the end of this article. You can scroll down for a quick reference.

Let’s get to know them more!

- 1. Control / Presence of a Middleman: Centralized Exchange vs Decentralized Exchange

- 2. Ownership of Assets: Centralized Exchange vs Decentralized Exchange

- 3. Security: Centralized Exchange vs Decentralized Exchange

- 4. Anonymity: Centralized Exchange vs Decentralized Exchange

- 5. User Friendliness & Complexity

- 6. Fees: Centralized Exchange vs Decentralized Exchange

- 7. Transaction Speed: Centralized Exchange vs Decentralized Exchange

- 8. Liquidity: Centralized Exchange vs Decentralized Exchange

- 9. Issues of price slippage and Front Running: Centralized Exchange vs Decentralized Exchange

- Comparison Table: Centralized Exchange vs Decentralized Exchange

- Summing Up!

1. Control / Presence of a Middleman: Centralized Exchange vs Decentralized Exchange

In the case of centralized cryptocurrency exchange, the transactions are overseen by a company or an agency or the government. This means that a central authority undertakes management, decision making and operations of the exchange.

In the case of a decentralized exchange, as the name suggests, there are no middlemen or intermediaries. All the transactions are performed on the blockchain directly.

Even different well operating Decentralized Exchanges may have a certain level of centralization. Wherein, the marketing & development teams look after the product development of the network. Many DEXs invite their large investors on their boards to make decisions for the DEX.

Miners look after the operations and maintenance of the Blockchain. Even you can become a miner. Miners get a reward for maintaining stability on the blockchain. However, in the case of a Decentralized Exchange, the degree of centralization is always lower than a Centralized exchange. You can visit our article on the complete guide on Decentralization Exchange here.

2. Ownership of Assets: Centralized Exchange vs Decentralized Exchange

With a centralized exchange, you can deposit your money whether it’s the normal fiat currency or cryptocurrency. But, whenever you deposit the amount, you will lose control over it.

I will go a little technical here. There are two keys that hold the entire information about your cryptocurrency. Namely, the public key and the private key. The public key is visible to everyone. A private is the access key that is used to access your cryptocurrency. Now, in the case of a Centralized cryptocurrency exchange, the private key of your asset is with the exchange and not with you.

And it means that whenever you exchange your currency, it occurs as a transaction only on your behalf, not by you. The Blockchain doesn’t store all the transactions, and they digitally write off the total amount against your name!

The process is fast in comparison to that of a blockchain transaction which might take time for validation/verification of the transaction.

On the other side, in the case of a Decentralized Exchange, the ownership of the asset is with you. This implies that the private key of the asset is with you or saved in your wallet. Including staking wallets.

Historically, Centralized Exchanges have gotten hacked several times. As a result, many investors have lost their funds stored with Centralized Exchanges. So, it is important that you transact and store your cryptocurrency with a reliable Centralized Exchange.

3. Security: Centralized Exchange vs Decentralized Exchange

The custodial nature of centralized exchanges makes them the primary target of hackers/thieves. As CEXs maintain liquidity by keeping the funds of the users on their platforms.

Hackers are always on the lookout for loopholes in Centralized Exchanges. Since cryptocurrency is still evolving so are the Exchanges. Over time most of the Centralized Cryptocurrency Exchanges have improved their security. However, instances of them getting hacked are not uncommon.

These days, most of the Centralized Exchanges have added biometric verification and 2-Factor Authentication (2FA). Both of the above security features provide a sigh of relief to the investors.

2-Factor Investors (2FA) enables investors to access their funds after they provide their passcode from another device or application.

For instance, with 2FA, Binance requires you to enter your password and a passcode received on your SMS or Email.

In fact, you can enable Google Authenticator or Binance Authenticator on another device to provide an extra layer of safety. Such a feature is also available at KuCoin, OKEx, WazirX etc.

In contrast to the above, Decentralized Exchanges are relatively less prone to hacker attacks. Since the decentralized exchanges work on blockchain technology it becomes difficult for hackers to crack in. To hack a blockchain the hackers need access to at least 51% of the network. Which isn’t practical for most of the DEXs.

Blockchain is a very safe technology. However, the hackers can hack into the Decentralized Finance applications (DeFi) if they have poorly coded “Smart Contracts“.

Further, both types of exchanges suffer from something termed as an “Exit Scam”. Wherein, the team of a listed coin or token vanishes overnight after raising money from the public. Accordingly, it is please undertake thorough due diligence before investing in any of the Altcoins.

4. Anonymity: Centralized Exchange vs Decentralized Exchange

Apart from the abovementioned security lacks in the case of a Centralized Exchange. You need to submit your KYC (Know Your Customer) documentation with Centralized Cryptocurrency exchanges.

Contrastingly, there is no requirement of a KYC in the case of Decentralized Exchanges. In a Decentralized Exchange, you just need a Wallet like Metamask or Trustwallet to log in to the platform. All the transactions take place directly through your Wallet.

Hence, DEXs maintain a great level of Anonymity which CEXs do not maintain.

Suggested reading: Metamask Vs Trust Wallet

5. User Friendliness & Complexity

Since an organisation takes care of a Centralized Exchange, centralised exchanges are comparatively easier to use. A classic example of this would be Binance which is privately managed. And has a really easy to use interface. Apart from a Pro interface that is used by experienced investors. Binance also has a ‘Lite’ version of the interface for new investors to quickly pick up.

OKEx has a unique feature where users can trade in real-time without using their own funds. This helps new users to get a feel of real-life cryptocurrency trading.

KuCoin provides users with the ability to use a trading bot. Here, users just have to create a trading bot and the rest is all taken care of by the algorithm. The algorithm itself buys and sells on your behalf. And automatically books profits.

In comparison to the above Centralized Exchanges. Decentralized exchanges have a complex interface. New users may get puzzled by the process. Connecting a wallet, deciding slippage, waiting for the correct time to place the order and then swapping the currency may be troublesome for most new users initially.

Further, Decentralized exchanges do not offer as many products as Centralized Exchanges do.

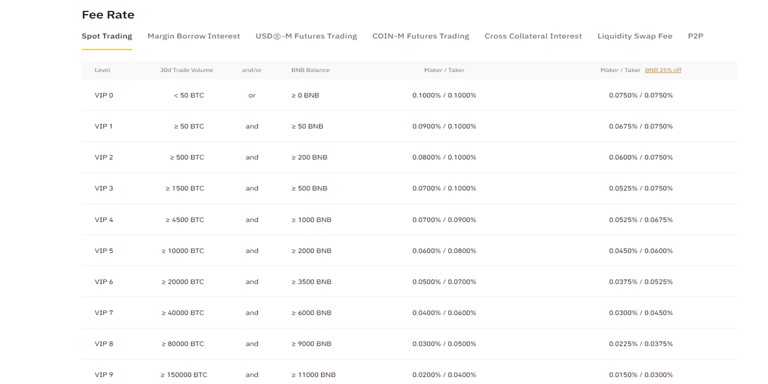

6. Fees: Centralized Exchange vs Decentralized Exchange

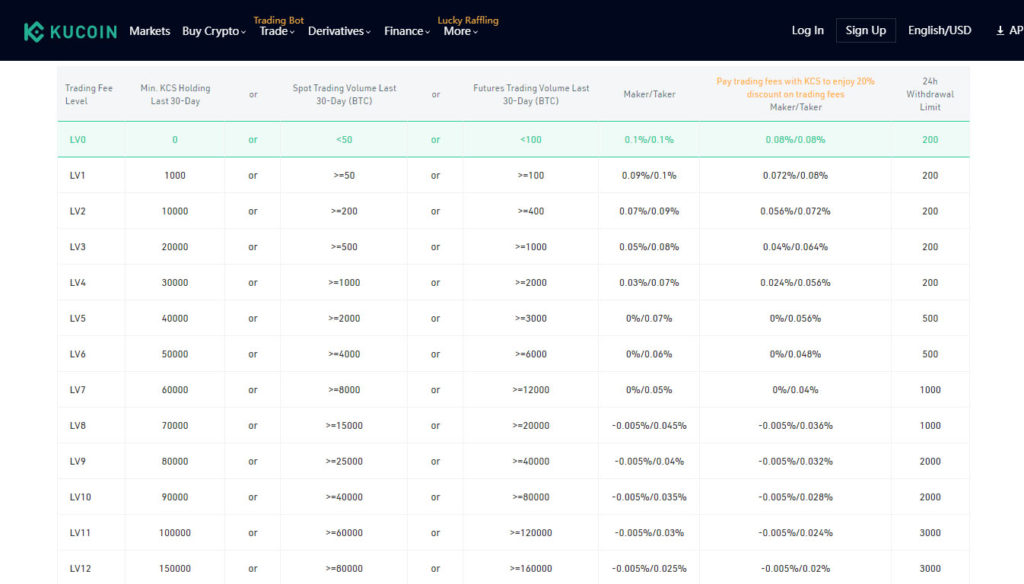

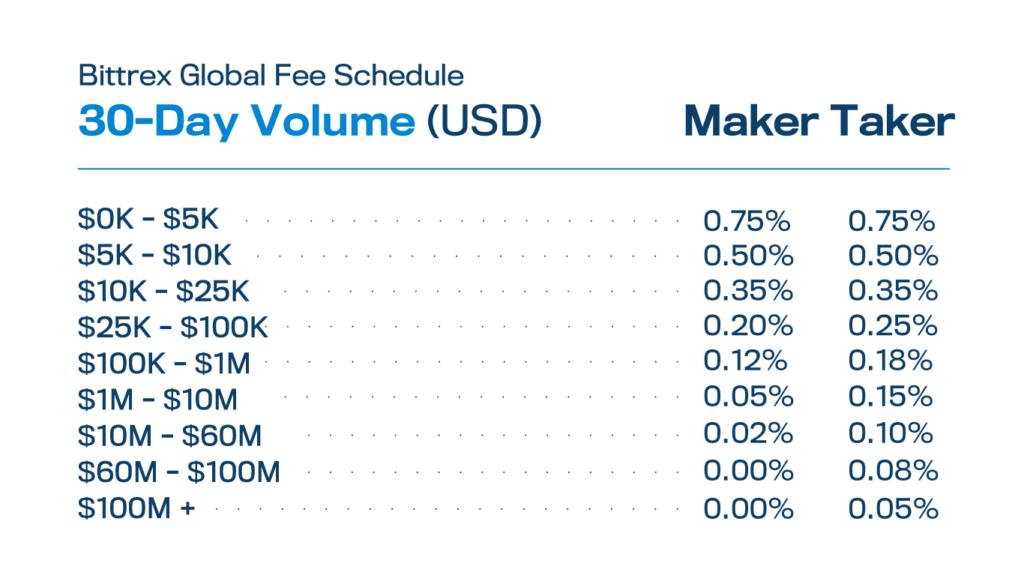

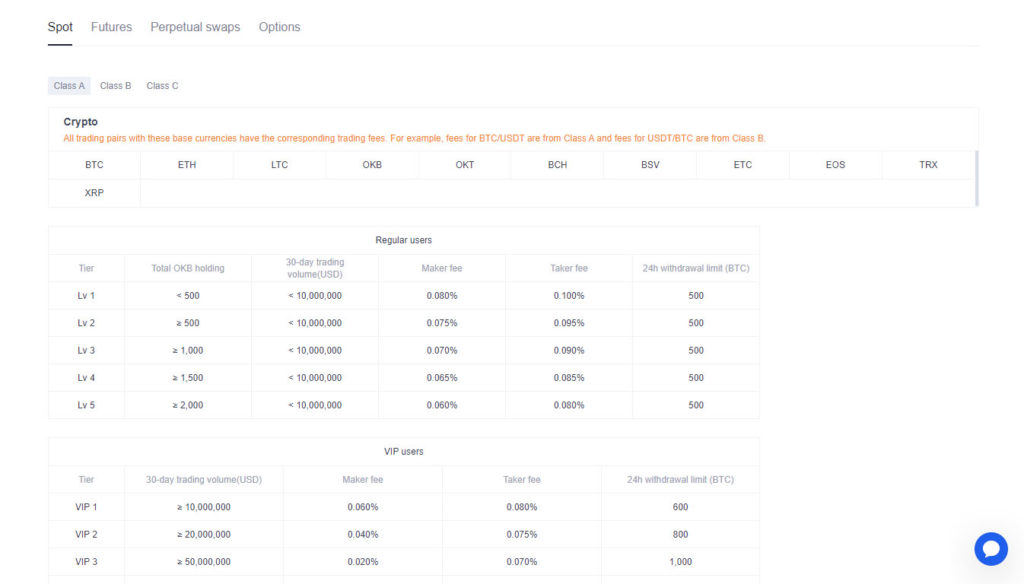

Since Centralized exchanges spend a lot of money on the overall look, security, development of products etc. It becomes obvious that the commission charged by Centralized Exchanges will be higher. Consequently, Centralized exchanges charge an average 0.08(OKEx)% to 0.5% commission on each transaction.

Below is the fees structure of some of the popular Centralized Exchanges:

On the other hand, Decentralized Exchanges typically charge similar fees. Unlike Centralized Exchanges, there are gas fees also associated with transactions. The fee charged by different Decentralized Exchanges is as below:

- Uniswap: 0.3%

- PanCakeSwap: 0.2%

- Sushiswap: 0.3%

7. Transaction Speed: Centralized Exchange vs Decentralized Exchange

In the case of Centralized Exchanges, the transaction speed is noticeably faster. This is due to the fact that the exchanges undertake transactions on your behalf. To elaborate further, whenever you buy, sell or exchange a cryptocurrency on a CEX. You make a transaction against the liquidity pool of the CEX.

So, there is no actual buying or selling of the asset on the blockchain. And it is later on that the transactions get recorded on the blockchain. This is one of the reasons why you find different rates of the same cryptocurrency on different centralized exchanges.

From the above, it is quite apparent to conclude that CEXs have a faster speed. Particularly due to less use of Blockchain directly. Just to add, CEXs spend loads of money on updating their platforms and servers. This also contributes to the exceptionally high speed of transactions that you would notice on CEXs.

On the contrary, Decentralized Exchanges interact directly with the blockchain. This interaction makes the transactions slower.

Further, DEXs spend a comparatively lower amount on the development of the platform. And most of the DEXs are developed in phases. A typical CEX will resolve an issue faster than a DEX.

Hence, it’s not only the transaction speed that differs, it is also the pace of development that differs for both the exchanges.

8. Liquidity: Centralized Exchange vs Decentralized Exchange

Due to the convenience and simplicity of Centralized Exchanges, more users prefer using them. Centralized Exchanges account for almost 95% of the total cryptocurrency transactions. For comparison sake, at any given time, the top 10 exchanges (volume-wise) would always be CEXs.

Binance, Coinbase, FTX, Kraken, KuCoin are the top 5 exchanges followed closely by Huobi. Their relative positions keep varying but Binance would normally top the chart. If you are new to investing then you should look for any of the above-mentioned exchanges. The preferred one though is Binance because of its simplicity.

When it comes to DEXs, they do not enjoy high liquidity. Even after having better inherent security features, they lack the appeal to engage much with the users.

However, DEXs are very useful when it comes to certain tokens. You will never find all the cryptocurrencies at all the Exchanges. So, sometimes using DEXs for transactions becomes a compulsion.

9. Issues of price slippage and Front Running: Centralized Exchange vs Decentralized Exchange

Slippage in Prices

Since Decentralized Exchanges use Automated Market Makers (AMMs) to manage transactions on their platforms. There is an issue of slippage of prices. To understand more about Automated Market Makers and Decentralized Exchanges you can visit here.

Slippage of prices essentially means your acceptability towards prices fluctuations on a DEX. Unlike Centralized Exchanges which need a pinpointed price, Decentralized Exchanges need a range.

For example, if you want to buy a Cryptocurrency at a Centralized Exchange you can buy it for an exact price say $1.05/unit. But in the case of a Decentralized Exchange, you will have to give a slippage as well say 3%.

What this means is your exchange will take place starting at $1.05/unit. But due to exchange rate fluctuation during the completion of the transaction, you accept to buy the cryptocurrency in the range of 3%(+/-) i.e. $1.0185 – $1.0815

Front Running

All the transactions happening on a Blockchain are publicly visible. There can be a possibility where someone (normally miners, who have easy access to the blockchain) can push their transaction before yours. Resulting in your transaction completing at an adverse price or getting completely declined.

Since DEXs interact directly with the blockchain. Many investors have witnessed the terrible problem of Front running. Having said that many DEXs have found solutions to this problem.

Comparison Table: Centralized Exchange vs Decentralized Exchange

The following table depicts a summary of comparison amongst Centralized Exchange vs Decentralized Exchange (CEX Vs DEX)

| Feature | Centralized Exchange | Decentralized Exchange |

|---|---|---|

| Popular Exchanges | Binance, OKEx, KuCoin, Changelly, Bittrex | Uniswap, PancakeSwap, Sushiswap, 1inch Exchange |

| 1.Control | A third party controls CEXs | Unlike a CEX, DEX is not controlled by anyone. |

| 2.Ownership of Assets | With the CEX | With the investor |

| 3.Security | Good with 2 Factor Authentication | Since DEXs operate directly on the blockchain, the investments get highly secured |

| 4.Privacy | You have to provide your KYC | You are not required to provide KYC or create an account. The transactions take place through your cryptocurrency wallet |

| 5.User Friendliness & Complexity | As discussed earlier, CEXs are very user friendly and have a very simple interface. Further, operating a CEX is easy for a new investor | Relatively complex |

| 6.Fees | 0.08%-0.5% | 0.2%-0.5% |

| 7.Transaction Speed | Better when compared with any of the DEXs available in the market. | Since they operate on Blockchain, transaction speed is low. |

| 8.Liquidity | CEXs have very high liquidity. | Comparatively Low |

| 9.Other Issues | Unlike DEXs there is No price slippage or front running | DEXs are faced with the challenge of price slippage & front running |

Summing Up!

Centralized Cryptocurrency Exchanges have excelled remarkably in the Cryptocurrency space. Primarily due to the fact that they make huge investments in developing their platforms for speed, innovations, simplicity etc. As is evident from the quantum of users they attract, they are doing very well and will continue to do so in the future as well.

However, the core of cryptocurrencies is decentralization. The phenomenal success that cryptocurrencies enjoy in the financial markets today is because they are not controlled by anyone.

Likewise, Decentralization Exchanges are a step towards making the marketplaces decentralized. The relevance of Decentralized Exchanges cannot be ignored. The more you dive into the cryptocurrency arena, the more you will understand the importance of DEXs. Further, over time the features of DEXs would improve and provide a complete solution decentralized solution for the exchange of cryptocurrency.