Last updated on January 23rd, 2024 at 08:56 am

Learn Huobi Global, a top cryptocurrency exchange, started in 2013, offers spot and derivatives trading, staking, crypto loans, and more. It was created in Beijing to help people in China trade digital currencies. Soon, it became one of the major exchanges in China, especially for Bitcoin trading. But in 2017, because of changing Chinese regulations, Huobi had to move its services abroad. They set up in Seychelles and made a new headquarters in Singapore. Then expanded to different parts of Asia and the world.

They faced some issues, like accusations of wash trading in 2019, which they denied. Huobi then took steps to stop wash trading, and their trading volumes fell. Regulatory problems also led them to close their U.S. branch in 2019. Recently, they closed their Beijing branch and told their remaining users in China to close their accounts by the end of 2021.Despite these challenges, Huobi built a strong crypto ecosystem with its blockchain, Huobi Eco Chain, Huobi Token (HT), and a stablecoin called HUSD. Today, they serve millions of users in over 170 countries. In This article, let’s learn huobi and their services:-

Table of Contents

How To Create an account and Trade On Huobi ?

Setting up a Huobi account might seem tricky since it’s all in Chinese. These accounts are meant for new users, not big institutions, but both can use them .

Anyone can learn huobi process. Once you get through the tough verification, it’s pretty easy for beginners. They take security seriously, checking your email and real name. Your username and account name must match.

They even verify your nationality and require photos of your ID and three transactions. Then, you finish with mobile verification.

Login/ Sign Up: Learn Huobi

Now You learn Huobi. To start, create an account. New users click “Sign-Up.” Existing users login with credentials.

Signing up is simple: email/phone, set a password. Verify email code, access exchange.

Profile

In the Profile tab, check your email and UID. Below are security and account settings to update. To boost account security, visit your profile, set up 2FA and verify your identity. Let’s learn huobi now.

Account & Security

Users come here to configure security options. Find ID verification, 2FA, password, currency, and notification settings. Set up 2FA by scanning a QR code with Google Authenticator. Add your phone for extra security. The exchange sends verification codes for withdrawals.

ID Verification

Create an account, verify your identity for security. Choose your account type: Personal or Institutional. For a Personal account, select it. Huobi offers four identification levels with varying limits. You can complete all four or a few levels as per your wish.

Fiat Setting

In this section, Let’s learn huobi to set up fiat deposit and withdrawal options. Remember, you must finish your KYC first for P2P transactions. The Fiat settings page allows you to:

1. Set your unique name for P2P trading display.

2. Add a payment method with collection details.

3. Add your Bank card information.

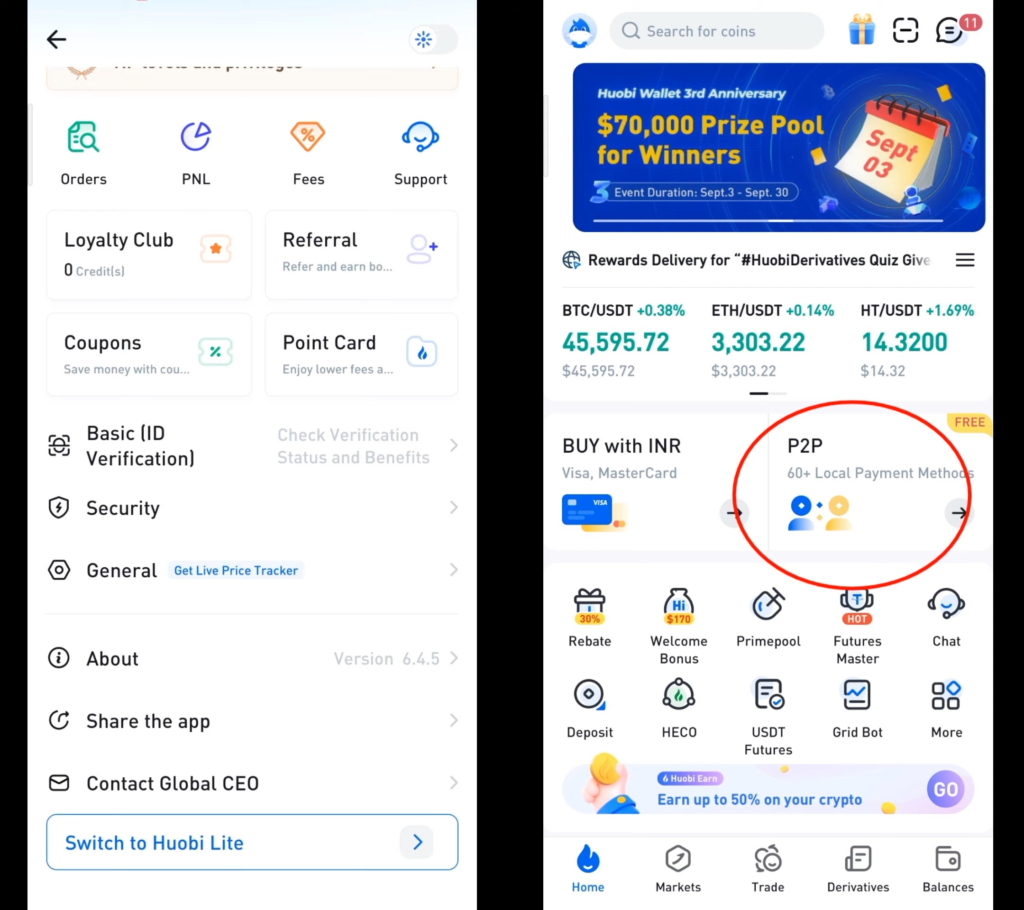

HTX P2P: Your Secure Trading Platform

HTX P2P offers easy and secure trading. Trade with zero fees, choosing your own price and payment method. Exchange Fiat for Cryptos and vice versa. Let’s Huobi learn To understand

Step 1: Complete KYC Verification

Log in, ensure KYC verification is done. Click “Identification,” access P2P Verification, click “Verify” to proceed. Choose your ID (ID card, Passport, or Driver’s license), upload a photo, and submit.

Step 2: Start Trading

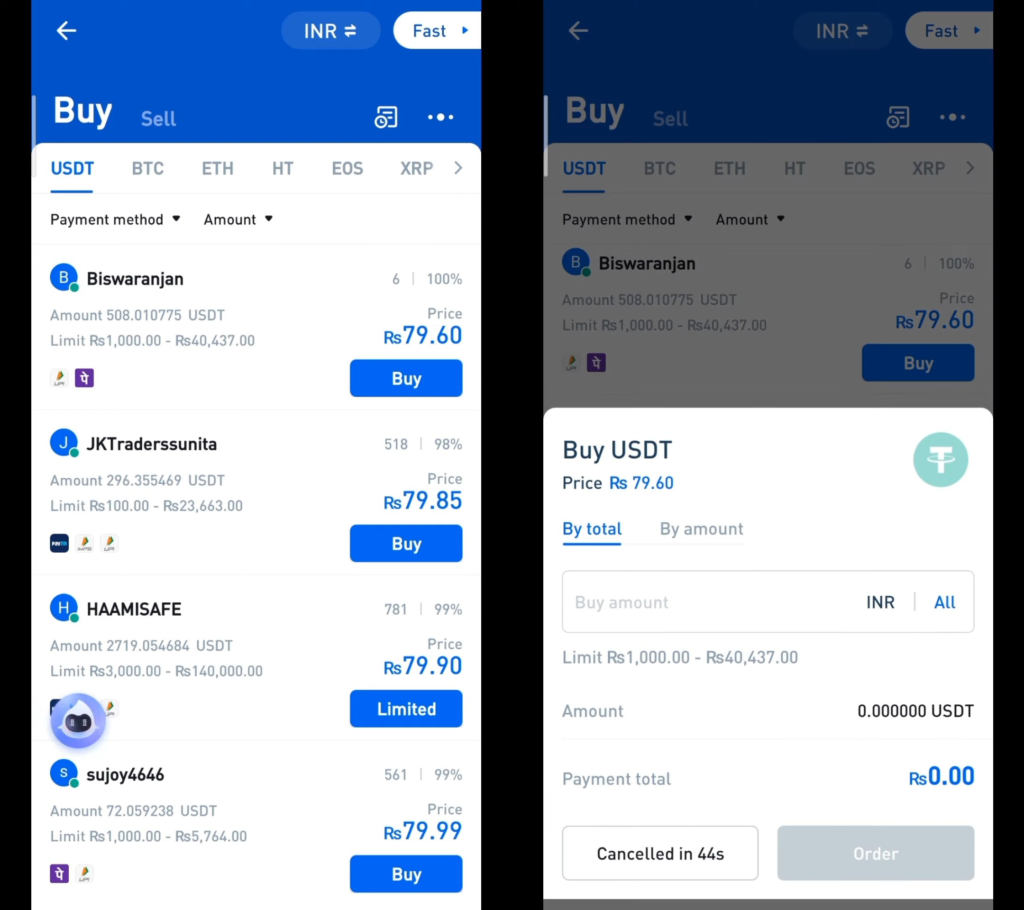

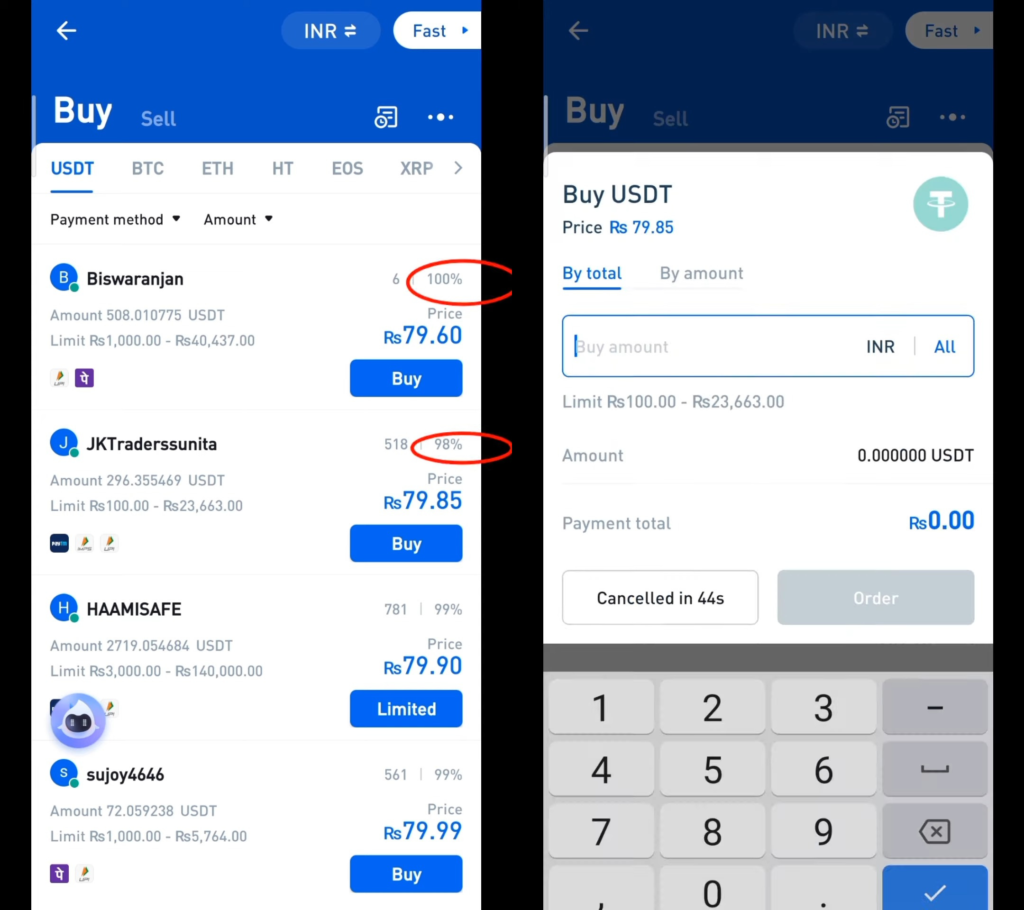

Click “Buy Crypto” and “P2P Market.” Select your Fiat currency (e.g., “INR”). See advertisements with price limits. Choose your preferred payment method, like a bank card.

Step 3: Place Your Order

Click “Buy USDT” on the selected advertisement. Enter the amount (e.g., 100 INR). After placing the order, transfer 100 INR to the advertiser’s bank account within 40 minutes. Your bank account must match your HTX account name.

Step 4: Confirm Payment

Click “Transferred, next” after making the payment. The payee confirms receipt. If cryptos are not released in 5 minutes, contact customer service.

Step 5: Complete Your Order

Once payment is confirmed, the payee releases your purchased cryptos. Check your balance in “View Balances” to verify the cryptos in your account. Enjoy your successful trade!

How To Do : Margin of Future Trading ?

Margin Trading lets you borrow funds for leveraged trading, allowing larger positions than your account balance.

- Log in, go to Trade > Margin, read the agreement, check the box, and click Agree.

Activate Margin Trading on the New Website

- Log in, go to Trade (beta), read the agreement, check the box, and click Agree.

Activate Margin Trading on the App

- Log in, tap Trade > Margin, read the agreement, check the box, and tap Agree.

II. Transferring Assets to/from Margin Account

- Tap Trade, then Margin, and transfer assets between the spot and margin accounts on the Transfer page.

Core Difference: Margin vs. Spot Trading

Margin trading allows borrowing to trade, offering short and amplified earnings opportunities.

Assets, Debts, and Risk Exposure

- Long exposure: Portfolio value rises with the token’s price.

- Short exposure: Portfolio moves opposite the token’s price.

- Borrowed token increases both assets and debts, maintaining a net exposure of zero.

- Selling a borrowed token creates short exposure.

For Example: Alice’s Portfolio

Alice has 1,000 USDT and 1 borrowed ETH.

- Net exposure to ETH is zero.

- After selling 0.5 ETH for 500 USDT, her net ETH asset is -0.5 ETH (shorting).

- A decline in ETH price reduces debt value, creating a profit.

- A rise in ETH price leads to a floating loss.

Long vs. Short Exposure

- Long exposure profits from rising prices.

- Short exposure profits from falling prices.

Relationship: Asset Value, Debt, and Investment Return

- Debt value stays static when borrowing stablecoins like USDT.

- Borrowing non-stablecoin tokens means debt value changes with token price.

- The relative valuation of assets and debts determines investment returns.

Margin trading is a financial tool that enables traders to borrow funds to trade assets, offering both long and short exposure to markets. By understanding the agreement and the dynamics of assets and debts, traders can navigate margin trading effectively and potentially profit from market movements.

Trading with Crypto Signals on Huobi

In the world of technology, blockchain spending is skyrocketing from $1.5 billion in 2018 to an expected $15.9 billion by 2023. The crypto industry is booming, offering new opportunities for both seasoned and beginner traders. One tool that’s gaining popularity is crypto trading signals. These signals, born from technical and fundamental analysis, provide guidance for buying or selling assets and setting profit and loss thresholds.

Trading Signals at Your Service

A group of professional traders creates these signals, which are then shared with subscribers on a signal platform. While some signals are free, it’s wise to invest in a premium service for higher-quality guidance. Choosing the wrong service can risk your capital.

Discovering Profitable Paths

The crypto industry may be young, but it’s already empowered countless traders to make a living and earn substantial profits. Numerous crypto signal providers cater to Huobi traders, offering a gateway to profitability.

Demystifying Crypto Signals

Crypto signals are straightforward instructions based on indicators, predicting whether an asset’s price will rise or fall within a specific time frame. They recommend entering a trade with precise values, like investing $30,000, setting a take-profit at $35,000, and a stop-loss at $25,000.

Conclusion

Huobi boasts over 3 million users, all familiar with automated trading signals. Whether you’re a seasoned trader or just starting out, these signals are invaluable.Now you Learn Huobi with this article. No matter your chosen exchange, be it Huobi or another, it’ll mesh seamlessly with a signal API. Correctly configuring your software for optimal trade selection yields substantial benefits. Crypto signal bots typically offer high precision rates, catering to your needs.

Huobi Global shines with its deep liquidity, extensive cryptocurrency support, and a wide range of yield opportunities. It’s a magnet for experienced traders. Regulatory hurdles, however, hinder Huobi Global’s worldwide expansion. Newcomers might find Huobi’s plethora of offerings overwhelming. Nevertheless, it’s a major player in Asian markets and stands strong against competitors like Binance, Bitfinex, bitFlyer, Bithumb, Coincheck, Gate.io, and KuCoin. After being ousted from China, Huobi gained global appeal by embracing multiple fiat currencies and payment options.