Last updated on March 13th, 2023 at 12:40 pm

Introduction

There are all sorts of traders when it comes to Cryptocurrencies. Ranging from highly engaged ones who are before their computer screens 24×7 to those who seldom visit their portfolios.

I am writing this article for the less active investors who aren’t able to spend much time waiting for the desired price to complete their transactions.

If you aren’t new to cryptocurrency trading I am sure you have heard of Trading Bots. Trading bots are a set of instructions that help you make a profit by buying low and selling high automatically.

One of the famous Trading Bot is Cryptohopper. And this article we are going to undertake a Cryptohopper review

Let’s glide forward!

1. What is CryptoHopper? How does it work?

Cryptohopper is an all-in-one trading bot that executes the trade on your behalf at the connected exchange’s account.

You can create a free account at cryptohopper here >>. However, you also buy a paid plan to speed up your success. We will talk about the different plans in a while.

To begin with, you need to connect your Cryptohopper to your Exchange account via the API key. You can enter this key in your exchange account settings. We will use KuCoin to demonstrate the same for understanding purposes.

However, presently, Cryptohopper is compatible with the following cryptocurrency exchanges:

- HitBTC

- OKX

- BitPanda Pro

- KuCoin

- Bitvavo

- Binance

- Binance US

- Coinbase Pro

- Bittrex

- Poloniex

- Bitfinex

- Huobi

- Kraken

The process of connection is going to be similar for most exchanges with small changes, but Cryptohopper provides all resources to link your account to other exchanges via its tutorial pages.

Once you have successfully linked your exchange account to your Cryptohopper bot you can execute trades automatically based on the applied settings or strategies as Cryptohopper terms it.

2. Features of Cryptohopper

Here’s a summary of what features Cryptohopper has:

- Mirror Trading

- Paper Trading

- Strategy Designer

- Trailing Stop Loss

- Backtesting

I know these terms sound complicated for beginners but I will discuss each of them in detail as we progress.

i. Mirror trading

Mirror trading allows you to trade strategies of experienced/professional traders. You can visit the Cryptohopper marketplace and buy templates, strategies, or signals.

Cryptohopper also offers free strategies, Templates and signals on its site that are hosted by third parties.

A template comes with a selection of coins, configuration settings, and so forth; These are offered as a combination of strategies. All templates/ strategies are screened by approved professional traders; These templates are indicators/parameters that decide the bot’s buying and selling decisions.

Signals are notifications that indicate the rise of a coin, and you may have to pay for third-party advice; if there’s an investment opportunity in a particular coin.

ii. Paper Trading

Paper trading is free! It is designed for users to learn about investing in cryptocurrencies without owning any coin or an exchange account.

You can virtually deposit an amount of 100k worth of cryptocurrencies to learn & experience trading without any risk.

Its very simple to operate, you can create a bot and make it run in the simulator to test it. If you do not like its performance, you can do tweak the bot and re do the same till you are happy with its performance before you step into real trading.

iii. Strategy Designer

As the name suggests, the strategy designer allows you to create crypto trade strategies. There are more than 130 indicators and patterns to choose from, it allows technical analysis and sets the best buying/selling signals from your strategy.

Although, you cannot edit a strategy; As a result, most traders use the virtual strategy designer to drag and drop indicators to create a new strategy. Once done, then you can upload the strategy to the backtesting (discussed later), so check it generates good buy/sell signals. Once, the strategy generates good signals, then you can implement the same!

iv. Trailing Stop Loss/Buy/Short

The bot provides three tools i.e., Trailing stop loss/buy, and trailing stop short. If you set your bot on trailing stop-loss; Then it will turn on stop-loss, which is when an asset value drops below a certain amount.

The trailing Stop buy keeps track of the coin prices, and if there is any uptrend; then the bot will stop buying & hold the position.

Trailing Stop short tracks the price down and closes the deal as the prices go upswing.

v. BackTesting

This features allows you to test your bot configs with past data. Once you create a bot and frame a strategy to execute. You would require it to be tested.

Cryptohopper gives you two options to test your strategies. One is Paper Trading that we have already discussed. And second is Backtesting wherein you can execute the bot on past data to check its working.

Paper Trading will take sometime to produce accurate results as you are running the bot on real time data. However, it is more accurate as it keeps the current trend into account.

On the flip side, Backtesting can provide quick results as it can be tested with a lot of data from the past. Again, it is not as accurate because current trend is not being considered.

In any case, you can use these features to ensure that your bot and trading strategies are profitable.

Please note that Cryptocurrencies are volatile. Even after you have properly created and tested your strategies, there is no guarantee for 100% success.

3. CryptoHopper Marketplace

Investors can use the Cryptohopper marketplace to purchase algorithms built by other traders. Many of these strategies are paid and are regularly tweaked by the makers, but you can also find free strategies on Cryptohopper.

This can be useful for new traders, as they can automate their trading based on someone else’s strategy. There are reviews, records, and breakdowns that explain what a bot can do!

On the Marketplace, you can find:

- Templates

- Strategies

- Signals

- Giftcards

- Apps

We discussed the above three already while discussing mirror trading above. Giftcards are self explanatory as you can gift templates, strategies and signals to your dear one from the Marketplace.

Cryptohopper marketplace showcases a number of apps. These apps can be used to conclude a number of actions automatically. For example, you can automatically tweet your best trade, swap cryptocurrency with Visa, Insure against a strategy (Vantage Triggers), scrub dust off your wallet and others.

4. CryptoHopper Pricing

Cryptohopper is available in 4 different pricing plans as follows:

Pioneer

The base plan is the pioneer plan, which is free. It offers 20 positions, complete portfolio management, and manual trading.

Also, it offers the following features:

- Live trading terminal

- Syncing positions

- Reserve positions

- Personal stats

- Global stats

- Strategy builder

- Strategy back testing

- 130+ indicators and candlesticks

- Compatible with all exchanges.

Explorer

The explorer plan starts at $19/month and is available for a 7-day free trial. It comes with all the features of the pioneer plan.

Here’s the complete list of features:

- 80 positions

- 15 selected coins/assets.

- 2 triggers.

- Technical analysis at every 10 mins of interval.

- 1 trading bot

- Copy-trading

- Backtesting

- Trailing features

- Stop loss

- Auto close

- Take profit

- Shorting

- DCA

Adventurer

The plan starts at $49/month and comes with the features of the Explorer plan.

Here’s the complete list of features:

- 200 positions

- 50 coins/assets

- 5 triggers

- Technical analysis at 5 min interval

- 1 Bot

- Exchange Arbitrage

Hero

The hero plan starts at $99/month, and it comes with all the features of the Adventurer plan.

Here’s the complete list of features:

- 500 positions

- 75 coins/assets

- Technical analysis at every 2 min interval.

- Signals on all coins

- Marketing arbitrage

- Market making

- Algorithm intelligence(Beta)

- Premium strategy indicators

5. Different Types of Automation with Cryptohopper

Cryptohopper is extremely flexible when it comes to automation. Accordingly, it can be used to create

- Manual (monitored),

- Semi-automatic and

- Fully-automatic

strategies to suit your needs. Let’s consider how you can leverage these automations:

i. Monitored portfolio management

Not everyone has to trade automatically. You can just connect Cryptohopper to your exchange, and trade manually using the pioneer exchange plan. You can utilize the paper trading feature to understand how the market works.

Also, you can use the advanced view to trade manually on your exchange. The active positions tab allows you to keep track of all your positions.

ii. Semi-Automatic Trade

If you have experience and want to make sure that there is no mistake/error on your crypto investments; you can do your analysis and buy your trades with “Advanced View.”

There are different tools such as the trailing stop-loss, trailing stop-buy, shorting to execute your trade strategies.

iii. Fully Automatic Trading

You can automate all your strategies with a Cryptohopper. Moreover, you can use different strategies to implement a buy/sell strategy with a Cryptohopper and scan all markets.

If you have a big portfolio of different cryptocurrencies, then you can exchange them for one!

Just enable the automatic sync feature. Cryptohopper will create positions for all your assets along with everything you receive. You can later decide to sell them at a predetermined price!

You can use any of these strategies to use Cryptohoppers to generate profits and gain experience in the crypto space.

6. Pros & Cons of Cryptohopper

Pros of using Cryptohopper

- Compatible with all cryptocurrency exchanges

- Easy to use and setup

- Wide range of supported cryptocurrencies

- Tutorial resources for learning

- Cryptohopper marketplace

- Paper trading.

- Affordable prices

- Copytrading

- Strategy backtesting

- DCA

- Automatic Stop Loss

- Live Trading terminal

- Strategy builder

Cons of using Cryptohopper

- Cost can be high, as you have to pay separately for everything!

7. How to connect Cryptohopper with Kucoin?

There are three steps to connect and use your Cryptohopper bot with KuCoin. I am assuming that you have already created a Trading Bot with Cryptohopper and that you have an account at KuCoin. If you do not have an account at Kucoin. You can create one here >>.

The steps are:

- Getting API from KuCoin that Cryptohopper can access

- Connecting the API with Cryptohopper

- Configuring Trading Bot at Cryptohopper

We will be discussing the first two in this article as the third one requires a detailed article on How to create a Trading Bot with Cryptohopper.

Step 1: Getting API from KuCoin that Cryptohopper can access

You have to log in to your Kucoin account. If you do not have a Kucoin account, you can create one here>>.

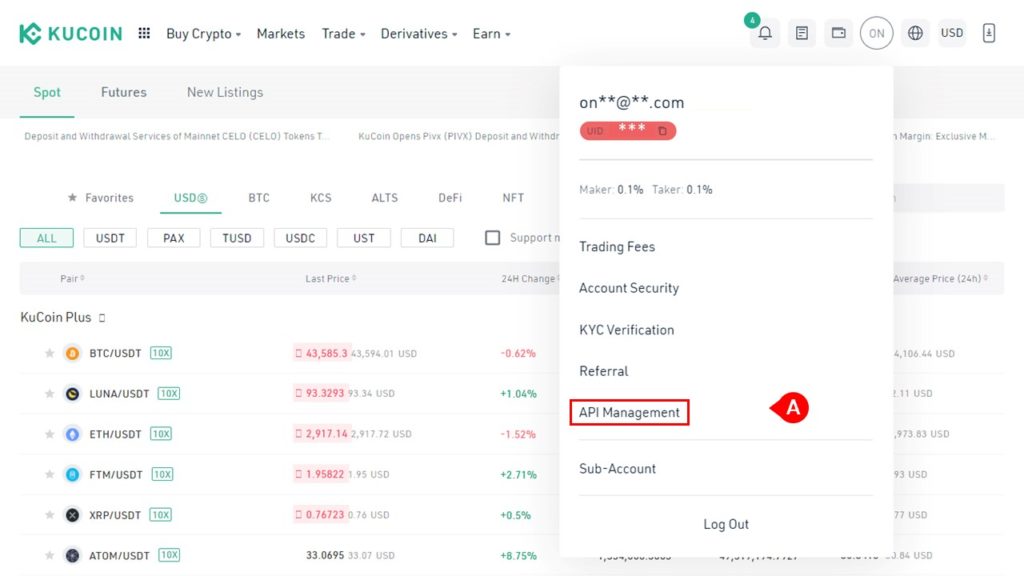

A. Go to the user profile tab on the top right of the page as displayed in the image below and click on “API Management”.

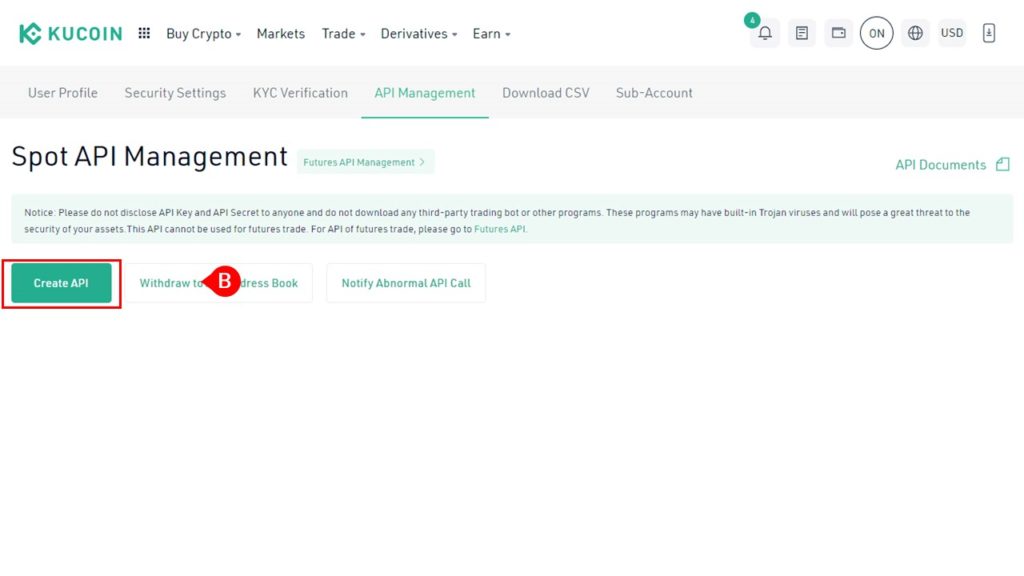

B. Next you have to click on “Create API” button as shown in the image.

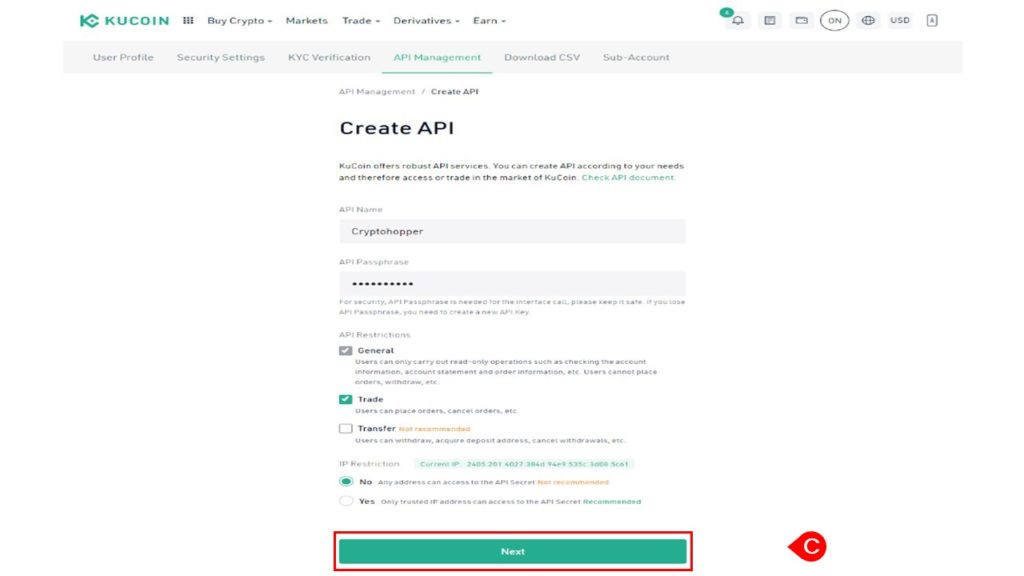

C. Once done, you will be taken to the Create API Details page. You have to enter the details for creating this API that you will link to Cryptohopper like:

- API Name,

- Passphrase,

- API Restrictions,

- IP restrictions.

You can fill in the Name and Passphrase as per your liking. However, for convenience sake we have taken the API Name as “Cryptohopper”. Please make sure that you do not disclose your Passphrase to anyone.

In the “API Restrictions” section, make you sure do not check Transfer checkbox for safety purposes. you do not want Cryptohopper to gain withdrawal access from your Kucoin account. However, you can check the “General” and “Trade” checkboxes.

IP restrictions can be at “Any address can access to the API secret”. Though this is not recommended by Kucoin but we will have to select this option. Because Cryptohopper is a cloud based service and has over 200 IP addresses which cannot be listed individually.

Now click “Next”.

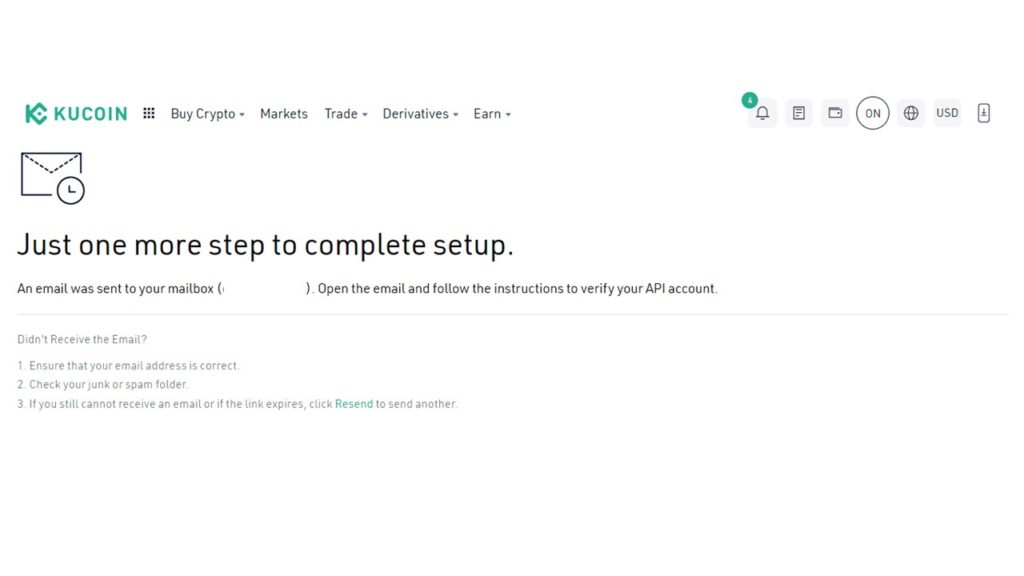

D. Verification for Trading Code, SMS & Email: Kucoin will ask for verification codes in this step. You can enter the Trading Code and SMS code. After this, an email will be sent to your registered email address containing the link for Activating API.

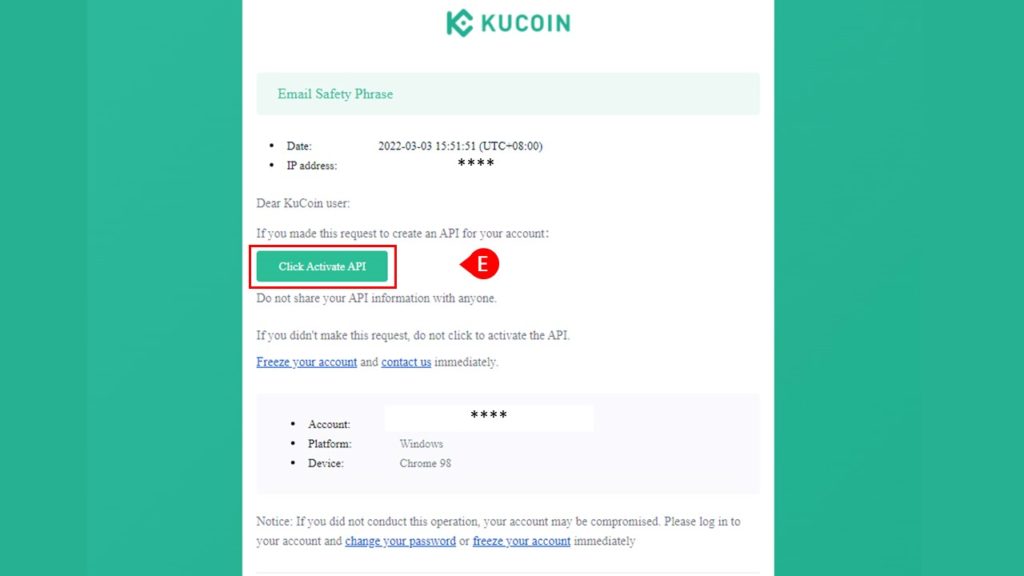

E. Now you can simply click on the “Click Activate API” button to activate your API. Below is the snapshot

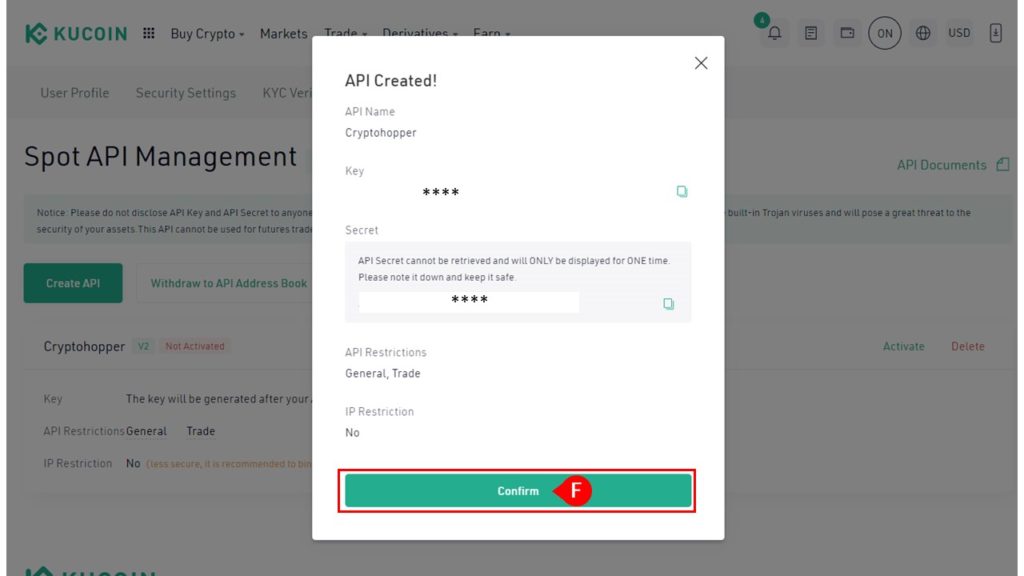

F. Finally, you will get a message like the one below. It contains your API secret, you can confirm it by clicking the “Confirm” button. Please note that you have to keep the API Secret key safe as it is both sensitive and displayed only once.

Step 2: Connecting the API with Cryptohopper

Now we move on to the next step in the process that is “Connecting the API with Cryptohopper”.

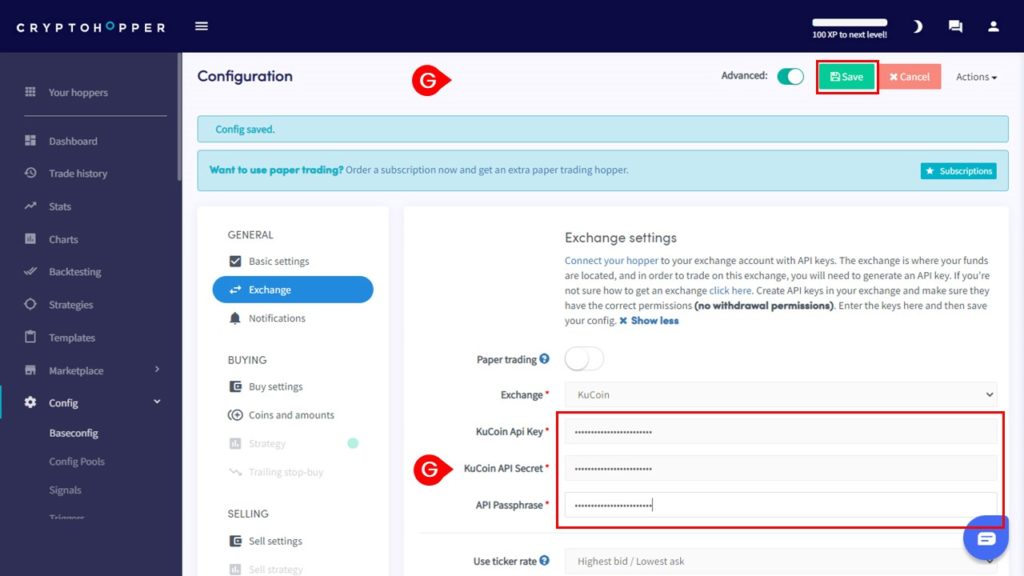

G. Login to your Crytohopper account. Click on config on the left. And navigate to the “Exchange” tab in the middle of the screen. If you have Paper Trading enabled switch it off and you will get options to enter API details.

Select Kucoin in the “Exchange” dropdown under the “Exchange Settings” and fill in the details from your Kucoin API that you just created.

Click on “Save” on top right corner and wait for sometime for the bot to accept the new configurations.

And Voila! Your Cryptohopper Trading Bot is now connected to Kucoin and ready for Bot trading.

Verdict

There are multiple ways to use a Cryptohopper trading bot. To get a hang of it, you can start with a pioneering plan which is free and use Backtesting or Paper Trading to test your strategy.

Though human intervention is normally necessary due to the volatility in Cryptocurrency prices. Moreover the volatility in Cryptocurrency prices does not guarantee a 100% success for Trading Bots.

Having said that Trading bots like Cryptohopper do provide relief for those who cannot invest much time into it. And have ensured good profits for casual investors.

It is a fully loaded tool with a lot of strategies that takes time for a new investor to get accustomed to. However, features like Mirror trading ensure that you can easily copy or buy professional strategies without much of a hassle.

If you time to understand the bot, you will find it really helpful for your trading needs.